Dingjiaoone Original

Author | Dawn

Editor | Wei Jia

Last year, China sold a total of 30.09 million cars, of which 4.91 million were sold overseas. If second-hand cars are included, the overseas figure would be an additional 310000.

This has enabled China to surpass Japan and become the largest exporter of automobiles.

In the first three months of this year, China sold 6.72 million new cars, of which 1.32 million were exported. Compared with the same period last year, the total volume increased by 11%, while exports increased by 33%.

This data can be considered explosive. Cars produced in China are accelerating their shipment to various parts of the world, including Russia, Mexico, Belgium, Thailand... In some countries, cars imported from China even account for more than half of sales.

BYD, Great Wall Motors, Chery and other car companies have formulated ambitious plans to go global, and BYD has even built its first roll on/roll off ship, with plans to increase to 8 in the future. Half of Chery's 1.88 million vehicles sold last year were exported. NIO and Xiaopeng have entered the European market, while Nezha has entered Southeast Asia.

We know that domestic car manufacturing is booming, Weimar is being rolled up to bankruptcy, Gaohe is on the brink of death, and Xiaomi, which has been rolled up from childhood to adulthood, has once again gained popularity. Ford CEO Jim Farr used the phrase "bloody reality" to describe the competition in the Chinese car market. In April last year, he brought the company's CFO to visit China and was shocked by the ongoing price war. The two looked at each other and said, "Oh my god.

So, going global has become an important way out for Chinese car companies. According to Zeng Qinghong, Chairman of GAC Group, "The current market trend is shifting from internal competition to external competition

This wave of Chinese cars going global will continue for some time. It is curious where a large number of exported Chinese cars have been sold? Which cars sell well abroad? How much room for growth is there in the future?

Where did 4.91 million cars go when they went out to sea?

Before discussing specific car companies and brands, we need to understand that cars are the jewel in the crown of industrial manufacturing, and not all countries have the ability to make cars.

Foreign trade involves tariffs and trade protection, and automobiles are strategic industries. Therefore, where a country's automobiles can be sold and where they sell well is not only related to the quality of the products.

Based on this understanding, let's take a look at the flow of China's automobile exports.

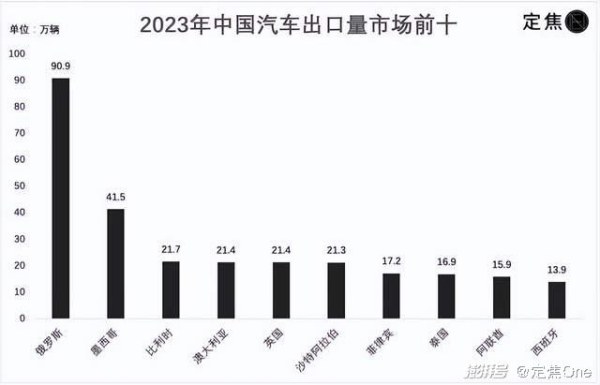

Data source/China Association of Automobile Manufacturers

This chart can help us establish a holistic understanding, but there are many tricks in the data that need to be further broken down.

Russia ranks first with 910000 vehicles, accounting for nearly one-fifth of China's total exports, far ahead.

As for the reason, it is related to the Russia Ukraine war. After the outbreak of the war, multinational car companies surrendered about 50% of the market. Russian domestic brands have taken over a portion, while the rest has been mostly taken over by Chinese car companies. Chery took nearly 120000 vehicles, Great Wall Motors took over 100000 vehicles, and then came Geely and Changan. In 2023, six Chinese car brands will enter the top ten in terms of sales in Russia.

Due to the war, after more than a decade, Russia has once again become the largest export market for Chinese automobiles.

Mexico is the second largest export market for Chinese automobiles. In Latin America, there are three countries that are important to Chinese cars - Mexico, Brazil, and Chile, with Brazil once being the largest market in Latin America. But in recent years, China's exports of cars to Mexico have been increasing, reaching 415000 units last year, far exceeding Brazil's.

Breaking down the data of these 415000 vehicles, we found that only over 100000 were actually registered and used in Mexico, while the remaining over 200000 went to other countries in North America.

Mexico has a unique geographical location as it is a neighbor of the United States. There is a North American Free Trade Agreement between the United States, Canada, and Mexico, which eliminates tariffs on many goods. Therefore, exporting goods from Mexico to North America is very cost-effective. So, a large number of multinational car companies built factories in Mexico to bypass tariff barriers on exporting cars to the United States, including Chinese car companies.

Mexico has become a transit point for Chinese car exports to the Americas. Ford CEO Jim Farley once mentioned that '25% of all cars sold in Mexico come from China'.

Therefore, the second place on this export list requires a more comprehensive view of the data.

The third place is Belgium, which imported 217000 cars from China in 2023, surpassing all other European countries. Belgium is not a big country with a population of more than 11 million. Previously, it was occupied by BBA. Suddenly, it imported so many cars from China. The reason behind this is similar to Mexico. Belgium is a transit point for Chinese cars to export to Europe.

Belgium borders multiple countries such as Germany, France, and the Netherlands, and faces the UK across the sea. Chinese cars entering Europe must pass through Belgian ports for transportation and distribution. Belgian Consul General in Guangzhou, Pei Weimin, has said that almost all Chinese new energy vehicles entering the European market are imported through Belgian ports.

Another thing to note is that the term 'Chinese cars' here refers to cars produced in China, not necessarily Chinese brands such as Tesla.

The cars produced by Tesla's Shanghai factory and shipped from Shanghai to other countries are included in China's export data. The first batch of Chinese made Model 3 in 2020 was loaded onto ships from Shanghai, destined for the port of Zeebrugge in Belgium, and then shipped to various European countries such as Germany, France, Italy, and Switzerland.

Last year, Tesla sold 365000 cars in Europe, some of which came from its Berlin factory in Germany and the rest from its Shanghai factory.

In recent years, Australia has been importing more and more cars from China. Australia does not have a car manufacturing industry and will not constantly initiate trade protection for cars. In addition, Australia has signed a free trade agreement with China, which has exempted Chinese cars from tariffs since 2019. Chinese car companies have therefore increased their presence in Australia.

There are also two major markets - the Middle East and Southeast Asia, which are important destinations for China's automobile exports. Saudi Arabia and the United Arab Emirates, which are relatively friendly to China in terms of trade policies, are among the top ten countries in China's automobile exports. The automotive market in Saudi Arabia has always been monopolized by Asian brands, and now the proportion of Chinese brands has increased. The sovereign fund of the United Arab Emirates has invested in several Chinese car companies. Southeast Asia has attracted a large number of Chinese car companies, and the degree of internal competition is approaching that of China.

Which car models are most popular?

China's exports of automobiles include both new energy and fuel vehicles, with fuel vehicles dominating.

Out of the 4.91 million vehicles exported last year, 3.707 million were gasoline powered vehicles and 1.203 million were new energy vehicles, with a ratio of approximately 3:1. In the first quarter of this year, the total export volume was 1.324 million vehicles, of which 307000 were new energy vehicles.

We know that China's new energy vehicles have great advantages, and almost all new energy vehicle companies are clamoring to go global. But in fact, in the past two years, the largest increase in export volume has still been for fuel vehicles.

This situation is determined by the distribution of countries mentioned earlier.

The two countries with the highest automobile exports in China, Russia and Mexico, as well as the rapidly growing Middle East region (Saudi Arabia and the United Arab Emirates), mainly buy gasoline cars. Especially in Saudi Arabia, there are very few new energy vehicles. Together, these four countries imported approximately 1.6 million fuel vehicles from China last year, accounting for over 40% of China's total fuel vehicle exports.

Image source/Unsplash

Going abroad to these countries, there is no need to compete for electrification and intelligence like new car manufacturers. Just make slight modifications to mature domestic fuel vehicles, combine them with reasonable pricing in the local market, and provide good after-sales service.

Cost effectiveness is the biggest label of Chinese fuel vehicles.

In the Middle East, Chinese fuel vehicles are known for their affordability. The best-selling SAIC MG5 has a starting price of less than 100000 yuan, far lower than other models in the same class in other countries. Other best-selling Chinese cars are priced around 100000 yuan.

The largest sales segment in Chile is the mid size pickup truck, and China's SAIC Maxus T60 is very popular locally, with a starting price of less than 160000 yuan, while Japanese cars in the same class are priced at over 200000 yuan.

The favorite Chinese cars among Russians - Haval First Love, Tiggo 7, and Geely Borui Pro - are all economical models. The best-selling Chinese cars in Mexico, including SAIC MG 5, Chery Omoda, and Tiggo 4, are also affordable.

Overall, Chinese fuel vehicles overseas mainly compete with Japanese and Korean cars in terms of price, with the market concentrated in countries and regions such as Russia, Latin America, and the Middle East. In Southeast Asia, where Japanese cars dominate, and Europe, where German cars dominate, Chinese gasoline cars do not have many opportunities.

However, the market that fuel vehicles cannot enter is precisely the opportunity for China's new energy vehicles. The best-selling regions for new energy vehicles in China over the past year were Europe and Southeast Asia. Among them, the UK, Spain, the Philippines, and Thailand are all among the top ten countries for China's automobile exports.

New energy vehicles are an incremental market with opportunities for overtaking on bends. Brands that survive the brutal internal competition in the Chinese market and are able to go global generally have strong competitive advantages abroad. However, at the current stage, Chinese new energy vehicles also rely on cost-effectiveness overseas.

For example, in Germany, the SAIC MG4 sells for 180000 yuan, which is 60000 yuan more expensive than in China, but still more than 100000 yuan cheaper than the Volkswagen ID.3, which is positioned similarly to the MG4 and manufactured locally in Germany. Previously, SAIC Volkswagen lowered the price of domestically produced ID.3 in China, which also caused dissatisfaction among German consumers because German made ones were sold for over 300000 yuan, while Chinese made ones were only sold for just over 100000 yuan.

By comparing the prices on both sides, the advantages of China's electric vehicle exports are immediately evident. So much so that a German dealer imported Volkswagen brand electric vehicles from China and tried to profit from the price difference, but was sued by Volkswagen Germany.

Low production costs are one of the biggest advantages of Chinese electric vehicles going global. The same car model, produced in China, even with tariffs and transportation costs, is still not expensive after export. The European Parliament stated in a briefing that the price of electric vehicles in China is 20% lower than similar products in the EU.

This has led to a phenomenon where some multinational car companies cannot sell their cars produced in China locally and instead export them from China to overseas.

For example, Ford Motor Company adjusted its China market strategy last year and planned to make Ford China its "export center" for business. No longer competing with Chinese car companies, but producing and exporting in China. The Ford CEO mentioned earlier, who is afraid of price wars, believes that "China is very important as an export base, and exporting fuel and electric vehicles from China is very profitable

Based on this background, a portion of China's automobile exports are contributed by foreign car companies such as Tesla and Ford. Excluding this portion of sales, the remaining cars produced by Chinese domestic brands can better represent the influence of Chinese brands.

Car companies compete in overseas strength

So, which Chinese brands of cars really sell well abroad?

Let's first focus on the chart compiled by the China Association of Automobile Manufacturers:

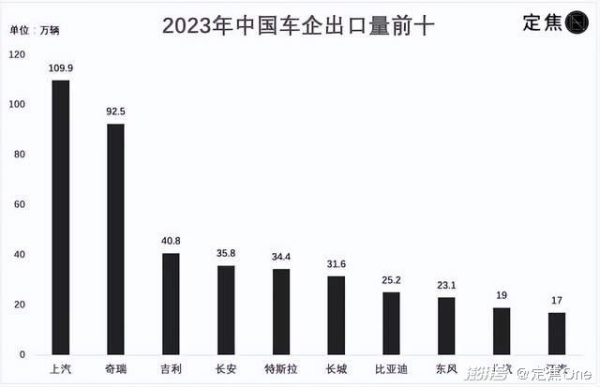

Data source/China Association of Automobile Manufacturers

SAIC and Chery can be regarded as the two giants of Chinese automobiles going global, far ahead of other car companies. After excluding Tesla, the top three independent companies (Geely, Great Wall Motors, BYD) have sold well, and Changan has always been the dominant player.

SAIC sold 1.208 million vehicles overseas last year (1.099 million exported and 109000 locally produced), ranking first. More than half of these 1.208 million vehicles were contributed by the MG brand, with 675000 vehicles.

The MG brand is very popular overseas, especially in Europe, ranking among the top three pure electric markets in the UK and Spain. Last year, MG brand sold 107000 vehicles in the UK, while China exported 214000 vehicles to the UK. The UK can rank as the fifth largest country in China's automobile exports thanks to the MG brand. In addition, MG brand also sells well in markets such as Thailand, India, and Brazil.

However, it should be noted that MG is not a native Chinese brand. It was acquired by SAIC from the UK and later launched two brand series, Roewe and MG. The MG brand already had a certain influence in Europe and resumed sales in Europe in 2019.

Besides the MG brand, SAIC's strongest brand overseas is SAIC GM Wuling, which sold 376000 units last year. Wuling mainly sells to markets such as Southeast Asia, South America, and Africa, with a focus on cost-effectiveness. Its market share in Indonesia is second only to Toyota and Honda.

Chery has performed outstandingly overseas in the past two years, doubling its sales by over 900000 vehicles in 2023, with exports accounting for half of Chery's total sales. From the perspective of a single brand, Chery is the top exporter of Chinese domestic brands.

In the past few years, there have been many negative voices about Chery in China. Its domestic sales and new energy transformation have begun to lag behind, but who knew it had quietly opened up a situation overseas.

Chery mainly sells gasoline cars overseas, and the Tiggo series is the main export model, focusing on "large quantity and affordable". Its main export destinations are Russia, Latin America, the Middle East, and other regions. Chery's outbreak also benefited from the sales growth in these markets.

Chery's growth momentum is still continuing. In the first quarter of this year, Chery exported 253000 vehicles, ranking first over SAIC.

Geely and Great Wall have similar company sizes, and there is not much difference in overseas sales.

Geely mainly focuses on emerging markets such as ASEAN, the Middle East, and Africa, and has expanded into Europe and Southeast Asia through the acquisition of Volvo and Proton. Its pure electric brand, Jike, is entering Europe, the Middle East, and other regions.

After the release of the "Ecological Going Global" strategy by Great Wall in 2022, the pace of going global has significantly accelerated, with all five of its major brands achieving this goal. According to the data released by Great Wall, it has entered over 170 countries and regions worldwide. In the first quarter of this year, Great Wall's overseas market sales accounted for one-third.

It is relatively easy for Chinese car companies to make money overseas, unlike losing money and making noise domestically. For example, Great Wall Motors had a gross profit margin of 15.5% for its domestic business last year and as high as 26% for its foreign business. Perhaps the profits of car companies in China are mutually exclusive.

Let's focus on new energy again. The main players in China's new energy vehicle exports are BYD and Tesla.

BYD only sells new energy vehicles, while Tesla only sells pure electric vehicles. Last year, the two companies exported 252000 and 344000 units respectively from China, accounting for half of the total exports of new energy vehicles. All remaining car companies, including new car makers such as "Weixiaoli", exported a total of 607000 vehicles.

Excluding SAIC's over 200000 vehicles, Geely and Great Wall will divide some of them, leaving only a small share for other car companies. The proportion of new forces such as "Wei Xiaoli" is very small.

The transformation of new energy in many overseas countries, like in China, has a gradual transition process, and the early beneficiaries of market dividends are still those traditional car companies. NIO's expansion into Europe has been very impressive, with many exhibition halls built, but not many cars sold; Xiaopeng is the same, it belongs to the category of thunder and heavy rain with small points. The two companies combined sold only a few thousand vehicles overseas last year.

Among the new forces, only Nezha has shown outstanding performance, selling 16000 units overseas last year. In Thailand, Nezha's electric vehicle sales are second only to BYD, ranking second.

However, the new forces currently have low sales overseas, not because their products are not strong, but because their production capacity, channels, and after-sales system have not been established yet. They have just established a foothold domestically, and it will take some time to go abroad. At least in terms of intelligence, they have almost no competitors when it comes to going global.

One example is that Ideal currently does not have overseas markets, but some car dealers privately export Ideal cars to Central Asia and the Middle East. Russian wealthy businessmen and Middle Eastern tycoons highly favor the Ideal L9. Last July, over 200 ideal cars were exported in parallel.

As BYD fully promotes its overseas business, it cannot be ruled out that in the future, China's new energy will go global like in China, presenting a situation where BYD dominates.

In the first quarter of this year, BYD exported 99000 vehicles, a 1.3-fold increase, while China's total new energy exports during the same period were 307000 vehicles, with BYD contributing nearly one-third, surpassing Tesla. Chinese car companies cannot beat BYD domestically, and they also have to face BYD's firepower when going abroad.

Epilogue

Looking at the world, there is no country with a car market as competitive as China's. With the acceleration of Chinese cars going global, overseas competition has also begun, and there are signs of price wars.

A senior executive of a domestic independent brand said that in just over a year, the Russian market has evolved into a "red ocean", with numerous Chinese car companies competing fiercely, and the level of competition is comparable to that in China.

The situation in Southeast Asia, Latin America and other places is also similar. In Thailand, after BYD, Nezha, and Great Wall Motors opened up their markets, Aion, Changan, and Xiaopeng followed suit and entered the market; In Mexico, SAIC and Jianghuai entered the market earlier. After BYD and Great Wall launched new energy vehicles locally last year, Nezha also announced the launch of its flagship model; In the United Arab Emirates, BYD and Jike both entered the market last year, and there are also a group of new Chinese car manufacturers eyeing the market.

Back and forth, in the end, Chinese car companies just changed their location. Especially for new energy vehicles, there are not many countries that are relatively open, have policy support, and low tariff barriers, which has led to a clustering of Chinese car companies going global. To achieve long-term development, it is necessary to engage in healthy competition. In addition to vigorously selling cars, all aspects of products, services, and after-sales service must be done well.

*The title image comes from Pexels.